Following the company’s update regarding its improved 2H16 guidance, BlueScope has released its 1H16 results to the market

Following on from its recent update to the market upgrading earnings guidance, BlueScope has released its 1H16 results to the market (click here for the ASX announcement). The result is highlighted by stronger earnings off flat revenue growth, offset by an increase in leverage resulting from the North Star acquisition. The company expects leverage to reduce over the next 12-18 months through operating cash flow generation. BlueScope has also provided guidance that 2H16 underlying EBIT will be up to 60% above the prior corresponding period (AUD131m) which translates to a guided 2H16 EBIT of AUD210m or roughly 9% below 1H16.

for the ASX announcement). The result is highlighted by stronger earnings off flat revenue growth, offset by an increase in leverage resulting from the North Star acquisition. The company expects leverage to reduce over the next 12-18 months through operating cash flow generation. BlueScope has also provided guidance that 2H16 underlying EBIT will be up to 60% above the prior corresponding period (AUD131m) which translates to a guided 2H16 EBIT of AUD210m or roughly 9% below 1H16.

Since BlueScope provided its recent earnings upgrade to the market, its share price has increased by 30%, while the bond price has remained relatively flat. We would have expected the bond to experience some form of a rally off this back of these results. We note that secondary market trading on the bond is relatively illiquid so the bond market may be playing ‘catch up’ on the improved performance. Or, perhaps the markets focus has been on the increase in the gearing ratio. As noted below, we believe gearing remains low in the context of comparable sub investment grade companies. With the company also planning to reduce leverage in the next 12-18, this should also contribute towards an improvement in the gearing ratio.

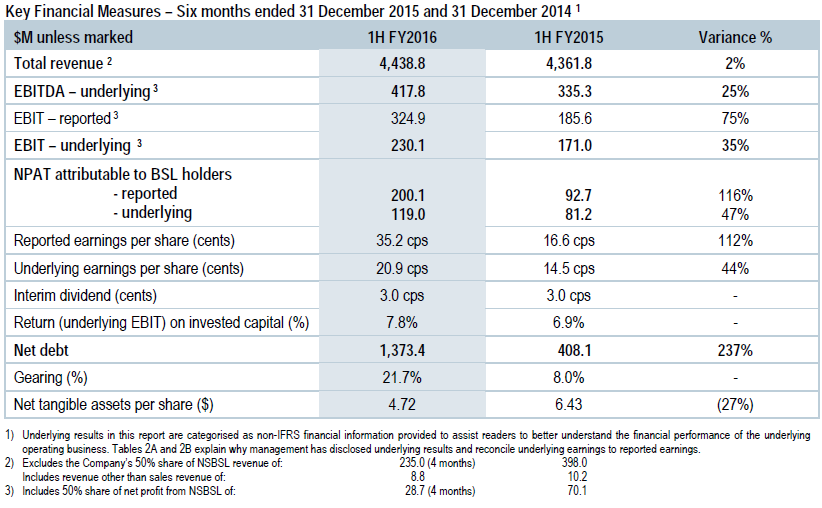

Key results

Source: BlueScope

- Revenue of AUD4.4bn was higher than 1H15 mainly due to favourable impacts of a weaker AUD, 100% consolidation of North Star effective from November 2015 and higher despatch volumes for the Engineered Buildings China division. These positives were partly offset by lower steel and iron ore prices

- As flagged in the recent earnings upgrade, underlying EBIT is up 35% to AUD230m. The main contributor to the increase in underlying EBIT has been a strong result for the Australian Steel Products division, which saw an underlying EBIT increase of AUD66.1m driven by lower costs and better domestic volumes/mix but a weaker spread

- Reported NPAT of AUD200.1m increased by AUD107.4m for 1H15 reflecting improved underlying NPAT and a revaluation the company’s existing interest in North Star when 100% ownership was acquired at the end of October 2015 (resulting in NPAT uplift). This NPAT uplift was partly offset by Australia and New Zealand asset carrying value impairment charges

- Net debt at 31 December 2015 was AUD1.3bn, up from AUD408.1m as at 31 December 2014. This increase is mainly due to the successful completion of the North Star acquisition. Continuing strong liquidity (undrawn debt plus cash) of AUD1.28bn

2H16 outlook

Notwithstanding a challenging macroeconomic environment, BlueScope expects 2H16 underlying EBIT to be up to 60% higher than 2H15 or around AUD210m. This guidance is based on significant cost reductions and process improvements that the company is implementing. Guidance for the second half of this year, assumes a AUD/USD exchange rate of 0.70, an iron ore price of USD40/tonne and a hard coking coal price of USD80/tonne.

In the Australian Steel Products division, BlueScope expects weaker pricing with the impact of lagged regional steel prices from late 2015, typical seasonality and destocking in volumes. The company also expects further cost savings, offset by timing of maintenance spend, including February’s scheduled blast furnace maintenance stoppage.

In other divisions, BlueScope generally expects spread pressure, with weaker pricing on its products partially offset by cost reductions. Volume growth is expected to be mixed depending on geography. In relation to the Hot Rolled Products North America, BlueScope expects a continued full despatch rate and improving spreads compared to 1H16, and will benefit from a full period of 100% ownership of North Star.

Conclusion

The BlueScope USD bond maturing in May 2018 is currently indicatively offered at a yield to maturity of 8.00% in US dollars and is showing very good value at this level. However, we note that supply has become more limited recently and the yield may tighten reflecting the improvement in financial performance.

Please contact your FIIG representative for further information and current pricing levels on the BlueScope USD bond. Available to wholesale investors only.